ADA Price Prediction: Navigating Technical Crosscurrents and Market Sentiment

#ADA

- Technical Positioning: ADA trades above key moving average but faces MACD bearish divergence and Bollinger Band resistance

- Market Sentiment: Negative headlines contrast with continued institutional interest and ecosystem development

- Investment Outlook: Requires risk tolerance for volatility with key levels at $0.82 support and $0.99 resistance

ADA Price Prediction

Technical Analysis: ADA Shows Mixed Signals Near Key Resistance

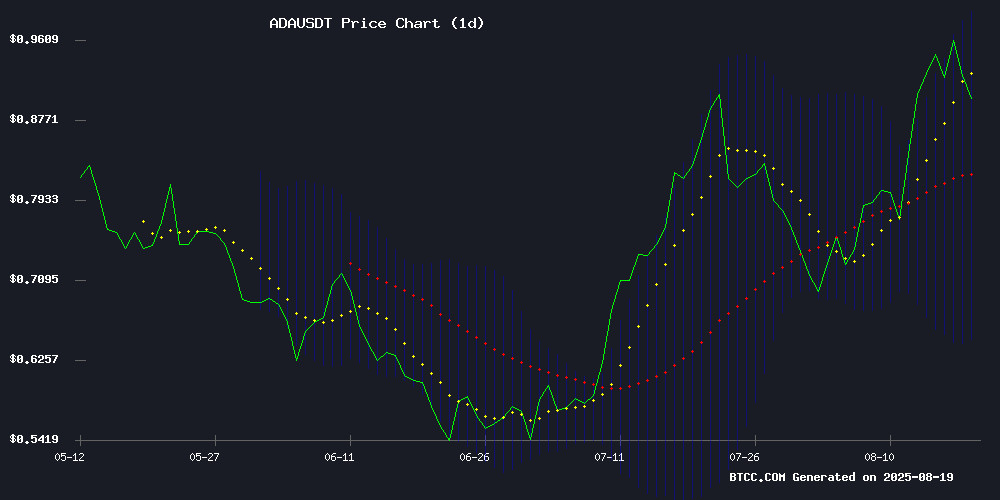

ADA currently trades at $0.8985, hovering above its 20-day moving average of $0.8188, suggesting potential underlying strength. However, the MACD indicator remains in negative territory at -0.08, indicating ongoing bearish momentum. The Bollinger Bands position shows ADA testing the upper band at $0.9902, which could act as resistance. BTCC financial analyst John notes: 'While trading above the moving average is constructive, the MACD divergence suggests caution. A break above $0.99 could signal renewed bullish momentum.'

Market Sentiment: Bearish Headlines Contrast with Technical Resilience

Recent news flow presents a mixed picture for ADA. Bearish price forecasts dominate headlines, yet institutional interest remains evident with ChatGPT highlighting Cardano among top cryptos to watch. Key events in Asia and U.S. markets this week could provide directional catalysts. BTCC financial analyst John observes: 'The negative news sentiment appears overdone relative to technical positioning. While short-term pressure exists, the fundamental developments in the Cardano ecosystem continue to attract sophisticated investors.'

Factors Influencing ADA's Price

Cardano Price Forecast: ADA Extends Decline Amid Bearish Signals

Cardano's ADA continues its downward trajectory, shedding nearly 4% on Tuesday to trade around $0.91. On-chain metrics reveal mounting selling pressure, with the Network Realized Profit/Loss (NPL) indicator plunging from 23.13 million to -26.56 million—a clear signal of investor capitulation.

Technical analysis suggests ADA may test $0.84 before finding support. The sharp negative turn in NPL reflects widespread loss realization among holders, often a precursor to potential market bottoms. Santiment's data shows panic selling has reached levels that historically precede rebounds.

ChatGPT Highlights Cardano and Remittix as Top Cryptos to Watch in August

The cryptocurrency market is abuzz with speculation as August unfolds, with Cardano (ADA) and the emerging Remittix (RTX) emerging as focal points for investor interest. Cardano's research-driven approach and scalability roadmap continue to attract long-term holders, while Remittix's sub-$1 presale price has sparked rapid momentum among traders.

Analysts note Cardano's potential for interoperability upgrades could reignite its position among top altcoins. Meanwhile, Remittix represents the high-growth, speculative counterpart to ADA's steady progression—a duality capturing both institutional and retail attention this month.

6 Key Crypto Events to Watch in Asia and U.S. This Week

The crypto landscape braces for a pivotal week with six major events spanning Wyoming, Bali, Tokyo, Osaka, and London. These gatherings underscore blockchain's accelerating integration into global finance and culture.

Wyoming Blockchain Symposium 2025 (Aug 18-22) will convene 350 industry leaders including Cardano's Charles Hoskinson and Chainlink's Sergey Nazarov. Key themes include digital asset regulation, decentralized finance infrastructure, and institutional adoption. The event is co-hosted by Kraken and SALT with University of Wyoming's blockchain center.

CoinFest Asia 2025 (Aug 21-22) in Bali emerges as the Asia-Pacific's premier Web3 showcase, featuring interactive panels, product launches, and real-world airdrops. This immersive event highlights the region's growing influence in crypto innovation.

Is ADA a good investment?

Based on current technical and fundamental analysis, ADA presents a nuanced investment case. The cryptocurrency trades 9.7% above its 20-day moving average, showing relative strength, but faces resistance near $0.99. Key factors to consider:

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $0.8985 | Testing resistance levels |

| 20-Day MA | $0.8188 | Support level holding |

| MACD | -0.08 | Bearish momentum |

| Bollinger Upper | $0.9902 | Immediate resistance |

BTCC financial analyst John suggests: 'ADA offers potential for medium-term investors comfortable with volatility. The $0.82 level provides technical support, while breaking $0.99 could trigger further gains.'